Table of Content

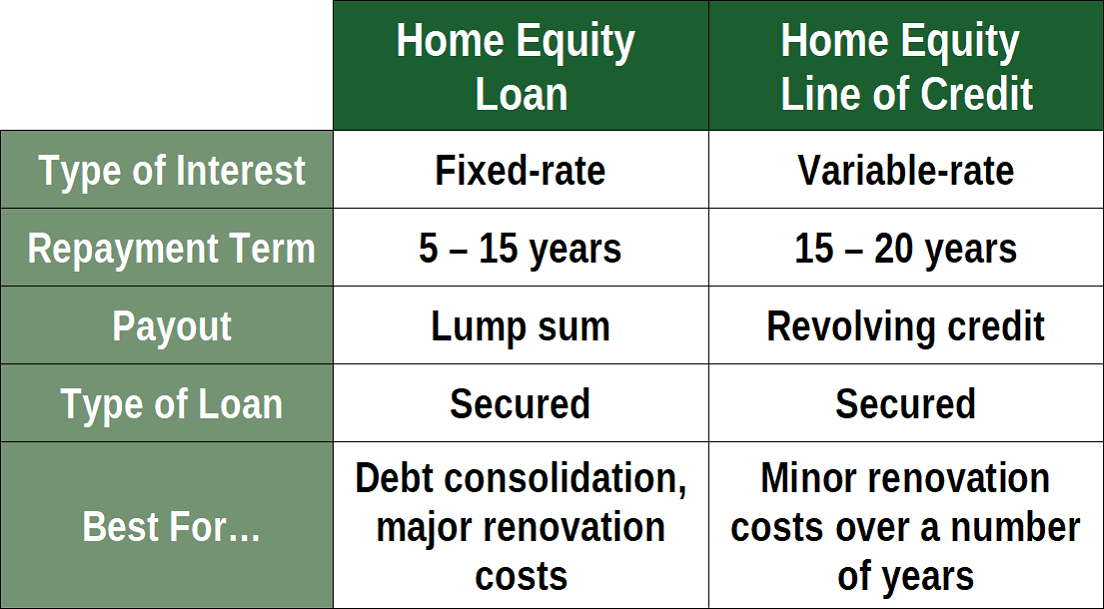

There can be other drawbacks, too, including high closing costs and the possibility that your children may not inherit the family home if they can't repay the loan. Interest charged on a reverse mortgage generally accumulates until the mortgage is terminated. All home equity loans generally have a fixed interest rate, although some are adjustable, while HELOCs typically have adjustable interest rates.

Opting for the shortest loan term possible can help you pay off a home equity loan faster, though keep in mind this will mean a larger monthly payment. In addition to loan disbursement and repayment schedules, interest rates are another big item for homeowners to consider when deciding between a HELOC and a home equity loan. Home equity loan rates are usually fixed, with rates often starting between 3.5% and 5.5%. You can use a cash-out refinance, a standard refinance, or a loan from your 401 if you need a large lump sum for a fixed expense.

How much can I borrow with a home equity loan or HELOC?

To give you a little perspective, though, the long-term mortgage rate average since the Federal Home Loan Mortgage Corporation started keeping records in 1971 is around 8%. A home equity loan may be better for a big, one-time expense like medical bills or high-interest debt consolidation. HELOCs are better when you want a flexible source of cash that you can tap as needed. Because a HELOC is a line of credit, you only have to pay off the amount you decide to use.

But the truth of the matter is that loan products provide different types of benefits for qualified borrowers. The goal for applicants is matching their ability to borrow with a loan that best meets their immediate and long-term goals. Although both loan types represent excellent low-interest borrowing opportunities, an increased number of people prefer a HELOC loan for the following core reasons.

Summary: Home equity line or 401K Loan: which is better?

Whether to choose a home equity line of credit or a home equity loan entirely depends on your financial situation. If you have uncertain or expect ongoing credit needs, a HELOC will likely be the best option, while a home equity loan may serve you better if you need a lump sum amount to finance a large expense. With a home equity loan, you will receive all of the funds in a lump sum when the loan closes, and be charged interest on the entire balance whether you use it right away or not. For buyers who are already comfortable with using PNC Bank as a mode of banking and are interested in flexible and fixed-rate options for their borrowing needs. A home equity line of credit, or HELOC, is a great way to finance home improvement projects, consolidate debt, or cover unexpected expenses.

Unlike a reverse mortgage, you don't have to be 62 to get one, and you have to start making payments on the loan shortly after taking it out. Because both solutions are based on your home’s equity, they often come with lower interest rates than other types of loans. This makes them great solutions for borrowing money, especially when you have big expenses on the horizon.

Time to Make a Decision

You'll save with great rates and a variety of terms, plus no annual fees and low or no closing costs. Most lenders will allow you to borrow up to 80% of the equity in your home. You’ll need to meet their requirements for credit score, debt-to-income ratio, and loan-to-value ratio, and will likely need to appraise your home. Most lenders will allow you to borrow up to 80% of the value of your home (some HELOC providers allow up to 95%) minus what you owe on your primary mortgage.

Your goal is to update some of your spaces and add value to your property. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government. Types of Savings Accounts Considering opening a savings account?

Pros and cons of refinancing

HELOCs are revolving credit lines that come with variable interest rates and, as a result, variable minimum payment amounts. In other words, you are borrowing your own money and paying it back over time with regular monthly payments. Home equity loans and lines of credit let you tap into your equity and use the cash for just about anything, such as home improvement projects, college tuition or debt consolidation. Focus your home equity financing on improving your long-term financial situation.

It works like a credit card that can be repeatedly used and repaid in monthly payments. It is a secured loan, with the accountholder's home serving as the security. With a home equity loan, you’ll receive a lump sum payment that you can deposit in your bank account and use as needed. Your lender will provide a monthly repayment schedule, including principal and interest, and the loan’s term. During the first few years, you can draw from the line of credit and make interest payments only on the amount withdrawn.

Most lenders cap your combined loan-to-value ratio at 80 or 85 percent. That means you can’t borrow more than 85% of the home’s value when both mortgages are added up. You also need to be confident in your earnings and job security.

Most charge a fixed interest rate that doesn’t change during the life of the loan. You may be able to convert some or all of the balance you owe on a variable-rate HELOC to a fixed-rate loan. The HELOC vs Home Equity Loan decision often proves challenging for everyday people. But putting your property’s equity to work can be a financial game-changer. The ability to consolidate debt or make necessary household upgrades improve the quality of life for any family.

UNIFY offers low fixed rate home equity loans or variable rate home equity lines of credit, also known as a HELOC. Review your options below and decide which home equity loan/line is best for you. Unlike a home equity loan, you won’t start repaying a HELOC right away. Instead, you’ll have a draw period (usually 5-10 years) during which you can use the credit line and make only minimum interest payments.

Competitive rates - You'll usually save big when comparing home equity rates to credit cards and personal loans. Get a fixed-rate loan with all your funds in a lump sum and consistent monthly payments. Keep in mind that because home equity financing is secured by your home, you risk losing your home if you default on the contract. Home equity financing may be either a loan or a line of credit. With a home equity loan, you receive a lump sum against the equity in your home.

No comments:

Post a Comment