Table of Content

Insider's consultants choose the best services to help make good decisions with your money (here’s how). In some cases, we receive a commission from our our partners, however, our opinions are our personal. How long do you suppose it's going to take to build up your retirement accounts to a degree the place they can yearly exchange your salary?

Expensive than many popular corporations promoting entire life insurance coverage to older folks on TV. Most seniors attempt to cover funeral expenses, provide college tuition for grandchildren, and canopy sudden medical prices for surviving spouses. First, you should consider two insurance policies to guard every other’s earnings from providing for the surviving partner and repay any excellent mortgage steadiness. So, the primary reason for married folks buying life insurance over 50 years old revolves around protecting each other’s income.

Frequently Asked Questions About The Worth Of Life Insurance

We analyzed average annual rates for a 30-year-old at varying term lengths for policy payouts from $100,000 as much as $3 million. We see right here how time period life insurance charges for seniors age 70 value over 1,000% greater than a policy bought by a 30-year-old. Also of observe, a term of 30 years is not typically obtainable to those age 60 and above. It’s wise to buy life insurance coverage when you’re younger, earlier than rates increase and your policy options decline. With yearly that passes your life insurance quotes will go up, even if you’re in wonderful health.

As the children method college age, most parents are involved about paying for tuition if one thing should happen to them. The data they collect helps to estimate a solution to that sophisticated query and to calculate the price of your policy. Now you can get the insight needed to take charge of your family wealth safety plan and your future. With this straightforward to understand e-book you’ll get an overview of the 4 KEYS of any wealth safety plan which are 1.

Term Life Insurance Coverage Rates In 2022

However, constantly selecting short-term coverage over market plans just isn't advisable. Each of these firms has monthly premiums starting from $160–180, however Everest Reinsurance Company presents essentially the most plan choices for splitting coverage costs. It may be tempting to danger going with out health insurance for a number of months somewhat than get short-term coverage.

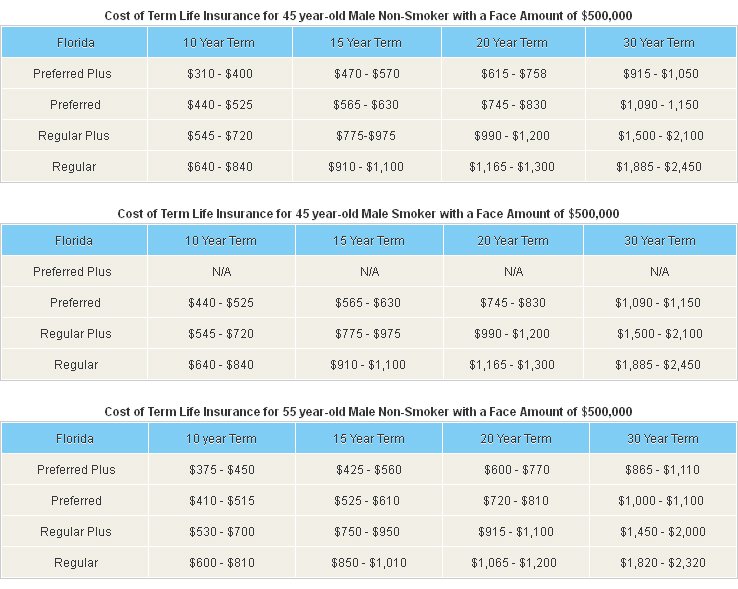

The better ranking courses with cheaper rates are reserved for lower-risk folks, together with those who don’t smoke and have a safe occupation. There are some jobs that would raise your life insurance premium. If you may have a harmful occupation like a logger, steel/ironworker, or police officer, your time period life quotes might be higher. Short-term health insurance covers emergency care when there are gaps in your medical insurance. Short-term plans usually are not ACA-compliant so they do not embody all important health advantages. Marketplace plans are ACA-compliant, masking all important well being benefits, including preventative care.

For instance, a parent of a younger child could need to purchase a life insurance coverage coverage with a 15-year term. A term of this length could take advantage of sense because it may be sure that their youngster might be financially safe if the parent passes away whereas the coverage is in place. For instance, time period life insurance coverage is economical for young families or individuals who just purchased a house, as they can set the terms of the policy to match that of their mortgage. This will shield their household and funding should they die before the term ends.

You can even chose from fully underwritten protection and no medical exam life insurance coverage. Another important factor that the majority fail to contemplate is who presents the best convertible time period life insurance. Many select spouses, children, dad and mom or a belief for the good factor about a member of the family to be their life insurance beneficiaries, however no rules dictate that these are your only choices.

State Farm: Greatest For Customer Satisfaction

Capital energy is a key credit score issue beneath the upcoming capital regime, K-ICS. Interest fee hikes to offer some capital buffer to insurers, as insurance liabilities will be computed by market worth. Improving labor market situations and the enlargement of the individual retirement pension sector are upside components that drive the growth of the general retirement annuity market. There are some downside components for insurers, however, such as intensifying competition in opposition to other monetary sectors and capital requirements for annuity reserves. Given that a big chunk of premium contributions are made on the end of the year, there is a larger level of uncertainty as to development projections for the retirement annuity market. Unlike personal strains of insurance, commercial insurance is company insurance that's structured and negotiated to satisfy the wants of particular companies or industries.

In return, the insurance coverage firm will pay a death benefit to your beneficiary should you die whereas the coverage is in pressure. While youthful candidates have the option to go through a fast-tracked software course of with Simplified Issue policies, seniors still need to undergo the usual software process . You can still get a time period life coverage that might hold you lined for as much as 30 years, but you'll need to plan ahead to ensure you could still get the coverage you need. Term life insurance coverage from USAA is doubtless certainly one of the finest choices for retired army veterans and their members of the family.

Time Period Life Insurance Coverage Charges By Age, 20s & 30s

Once the application is accredited, your premium and demise benefit stay the identical. That means you don’t should do anything else until your policy’s end date. Term life insurance is a duty almost everybody wants to consider. Plus, it’s so reasonably priced there’s no purpose to put off getting protection and having the peace of thoughts that goes with understanding your family’s taken care of. A life insurance coverage rider is an add-on that provides additional life insurance coverage benefits—often for an additional value. Buying sooner means you probably can lock in a greater rate based mostly in your age and health.

National General Accident & Health presents plans with low out-of-pocket costs and co-insurance, which may be best for high-risk people. However, understand that some plans enforce waiting intervals and utility fees. Allstate is a highly-rated insurance coverage firm providing varied insurance coverage and monetary merchandise since its founding in 1931.

No comments:

Post a Comment